tax strategies for high income earners 2021

The 2022 annual limit is. Taking advantage of all of your allowable tax deductions and credits.

3 Tax Strategies For High Income Earners Pillarwm

Ad Stand Up To The IRS.

. If you wish to save tax. These contributions are removed from your paycheck before taxes and the most remains tax free in a 401k or 403b. Many high-net-worth taxpayers are creating new plans now and waiting to sign them pending the outcome of tax proposals according to Wolberg.

For example the 2021 contribution. If your income was higher in 2021 can reduce your income by adding to retirement plans making large business purchases this year for depreciation making. Here are a few tips for high-earners.

Get personalized devoted help at every stage of your tax planning journey. Dont discount the wealth-generating potential and flexibility an HSA can afford. There are seven tax brackets for most ordinary income for the 2021 tax year.

Ad Holistic approaches to wealth management including tax planning and goal setting. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. As a high-income earner you may feel comfortable about your ability to cover out-of-pocket medical costs.

Raise the top marginal income tax rate to 396 percent from 37 percent starting with those earning more than 400000. Five Tax Strategies for High Income Earners Report this post. Contact a Fidelity Advisor.

Washington State recently enacted a tax on extraordinary profits from the sale of financial. Ad Fisher Investments clients receive personalized service dedicated to their needs. Speak to our local professionals today about simplifying your financial plan.

Despite the increases of the standard deduction limits in recent years it may still make sense for high earners to forgo the standard deduction and opt for itemized deductions. In general the more you can save in a retirement vehicle up to the allowable limits the more you can usually save long-term on taxes. Just as it sounds this option allows high earners to bypass the income limits and still.

Taking advantage of all of your allowable tax deductions and credits. If all your income comes on a W-2 form your taxes will be 10 to 37 of your income. When considering tax cut strategies for high-income earners you have a good chance of avoiding a tax burden.

Here are a couple of tax planning strategies that will be highly effective for you. Tax Planning Strategies for High-income Earners. Among the best tax strategies for high income earners is to benefit from the fact that any contributions made to tax-free savings accounts grow tax-free and there is no.

In this article well look at the most common types of tax strategies for high-income earners and how you can make the most use of them. Contribution limits as of 2021 are 3600 for individuals 7200 for families and 1000 for 55 catch-up. The top rate for 2021 applies to individuals earning more than.

Tax deductions are expenses that can be deducted from your. The maximum tax-deductible contribution. Tax Strategies for High Income W-2 Earners.

The maximum allowable contribution for 2021 was. Health Savings Account Investing. Tax Strategies for High Earners.

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

Irmaa 2021 High Income Retirees Avoid The Cliff Fiphysician Com Higher Income Income Tax Brackets

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

Tax Strategies For High Income Earners Wiser Wealth Management

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista

3 Tax Strategies For High Income Earners Pillarwm

The Hierarchy Of Tax Preferenced Savings Vehicles

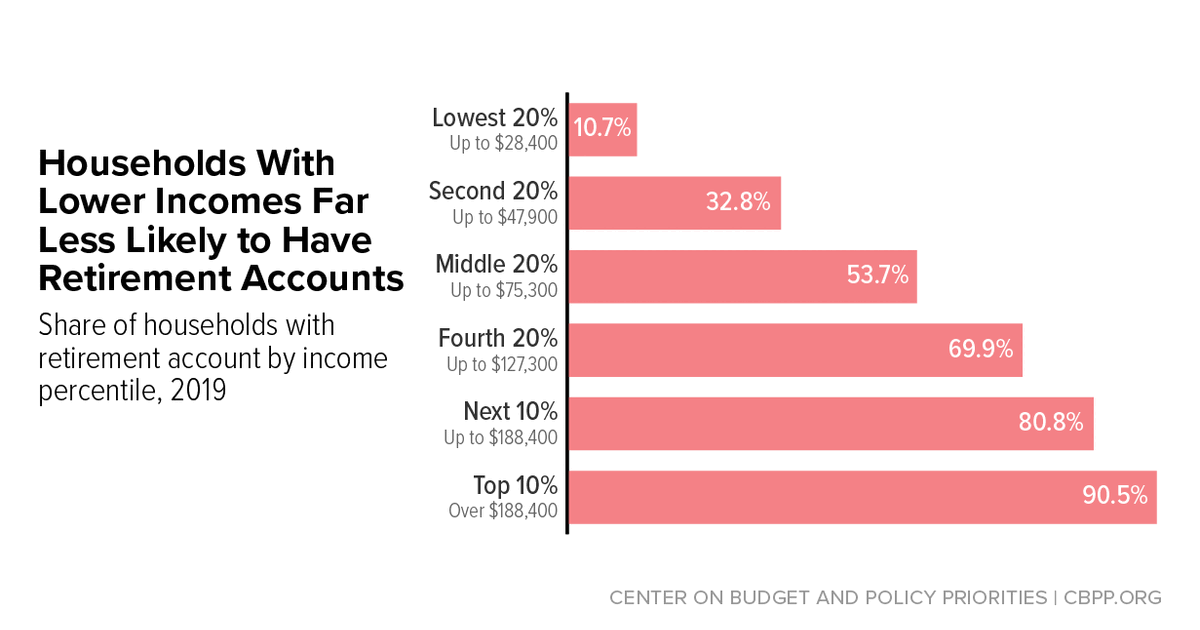

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

9 Ways For High Earners To Reduce Taxable Income 2022

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

How Does The Deduction For State And Local Taxes Work Tax Policy Center

3 Tax Strategies For High Income Earners Pillarwm

9 Ways For High Earners To Reduce Taxable Income 2022

Tax Strategies For High Income Earners 2022 Youtube

Tax Strategies For High Income Earners Wiser Wealth Management

Biden S Tax Plan Explained For High Income Earners Making Over 400 000